The session on continued competence at the October COLP and COFA Conference in Birmingham was enlightening. It left us in little doubt that there will be further pressure and perhaps new guidance early in 2024.

We already know that the SRA, whilst accepting that the identifying of learning requirements has to be done by an individual lawyer, they firmly believe that a firm’s management and ultimately the COLP, can assist by organising and supervising the identified CPD requirements.

The presentation, delivered by SRA Policy Associate, Richard Williams, can be viewed here and it is certainly worth a watch. From our perspective, it only reinforced the Matrix Capital view, that we can be a real ally to our law firm partners, when it comes to continued competence.

“How you would think about the challenges and quality of your practice – asking questions of yourself – where can I do things differently? Where can I improve? This helps identify any learning and development needs”.

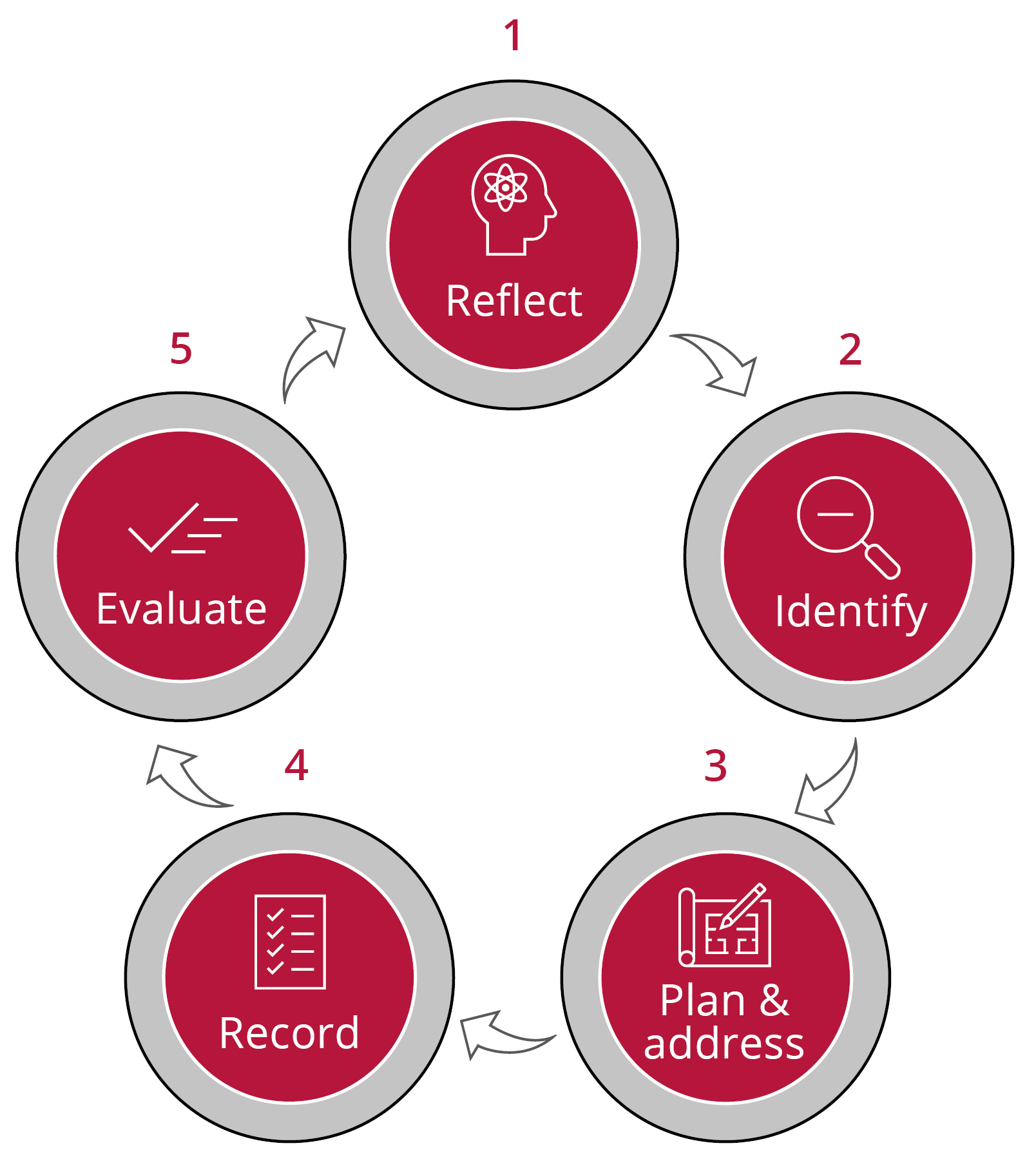

The process outlined by the SRA suggests that an individual lawyer must continually – reflect, identify, plan and address, record and then evaluate. We feel that we are qualified to support this process with individual solicitors or indeed, at firm level, when it comes to the cross over areas between legal and financial. Of course, it is our longstanding belief that because modern day clients have complex advice needs and problems which cross over the disciplines, that professional advisers, such as lawyers, accountants and financial planners should closely collaborate.

We can help the process.

There are so many areas of learning and development, which will constantly need to be refreshed in the areas of overlap where the work undertaken by a lawyer will need complementary financial input. In addition to the actual knowledge that can be shared, it is also vital as a lawyer to be able to recognise at what stage in a process the client they are advising needs to be referred to a carefully chosen third party financial planning partner. Particularly, in for example, the divorce process when a variety of pension assets, defined contribution or indeed future benefit, are involved.

Like you, our team at Matrix Capital have to undertake continual professional development and as such will be well used to designing training in a format covering objectives and learning outcomes, which the SRA wants the lawyers in your teams to record.

The training could be to update you or your teams on the financial tools, wrappers and investments that complements the legal advice you are providing or indeed might be on more generic areas that impact both professions. Below are a wide range of advice specific areas, followed by some more generic or regulatory subjects, where we feel qualified and happy to cover as part of an ongoing CPD programme. Indeed, we wrote about the library of support we have developed in Modern Law 66 (Pg 27.)

Advice specific

- The financial aspects of estate planning and where government tax reliefs, available via investment and pension vehicles, might complement legal advice.

- The financial aspects of divorce or separation and how and when financial advice will be required.

- The Investment of trust assets in line with the Trustee Act 2000.

- The options available when planning for care in later life for self-funders and how to reconcile the conflict with estate planning that often occurs.

Generic

- Vulnerability – how to identify and advise vulnerable clients and the regulators view on this vital subject.

- The use of cash-flow modelling in financial planning and how this can complement your legal advice.

- The difference between true financial planning and transactional financial advice.

- The importance of a client’s attitude to risk, how this is assessed and how it informs the creation of a financial plan.

- General investment market commentaries and updates.

Here to help!

The above list is by no means exhaustive, and we would encourage you to engage with your teams, identify topics and areas where they would value external input and then speak to the external financial planning partners that you trust and have a cross referral partnership with. If you are the Shropshire or wider Midlands area, reach out to us for an initial discussion.